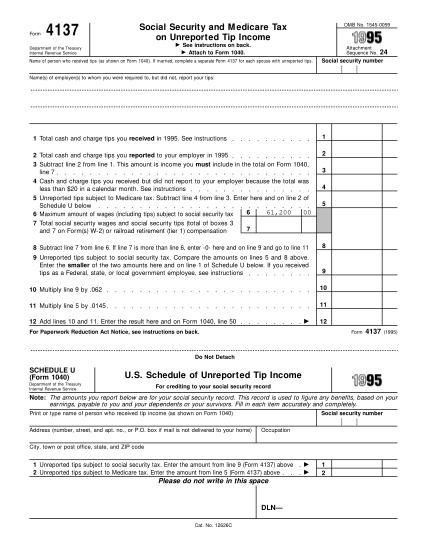

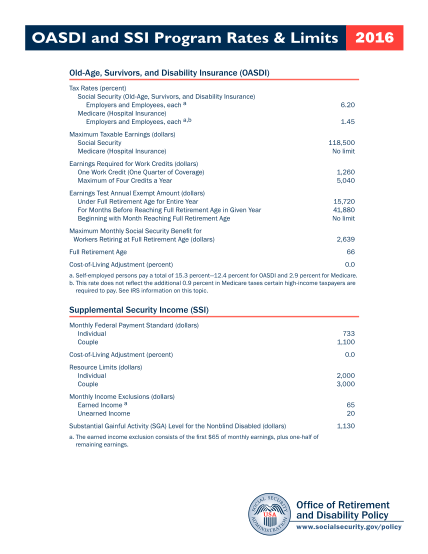

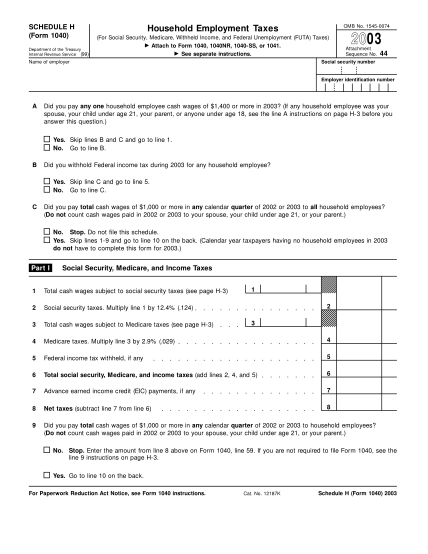

2003 44 Name of employer Social security number Employer identification number A Did you pay any one household employee cash wages of $1,400 or more in 2003 - irs

Schedule h (form 1040) department of the treasury internal revenue service (99) household employment taxes (for social security, medicare, withheld income, and federal unemployment (futa) taxes) attach to form 1040, 1040nr, 1040-ss, or 1041. see...

FILL NOW