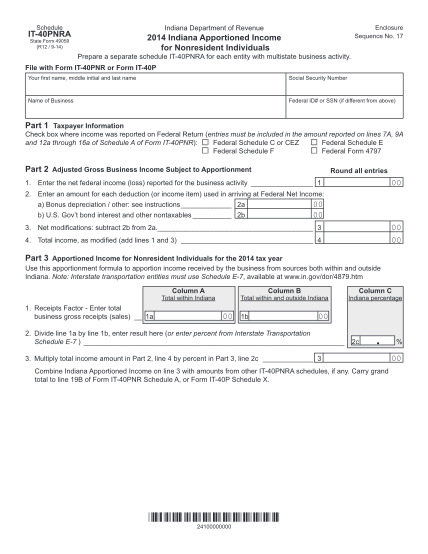

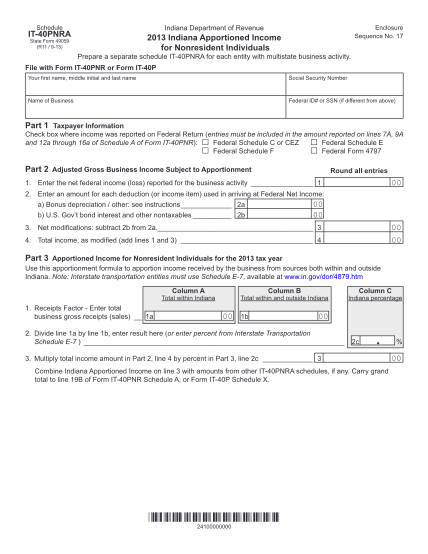

IT-40PNRA Indiana Apportionment Schedule for Nonresident Individuals

Schedule indiana department of revenue state form 49059 (r11 / 913) 2013 indiana apportioned income for nonresident individuals it40pnra enclosure sequence no. 17 prepare a separate schedule it40pnra for each entity with multistate business...

FILL NOW