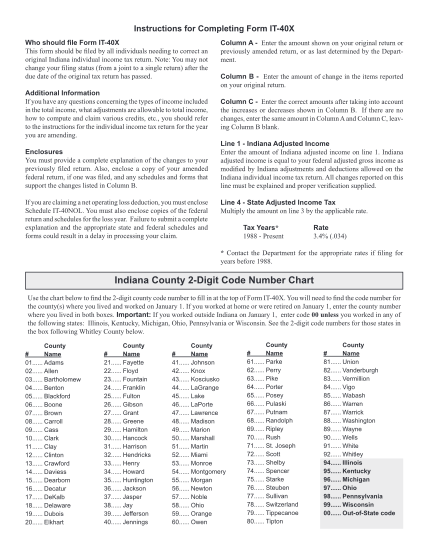

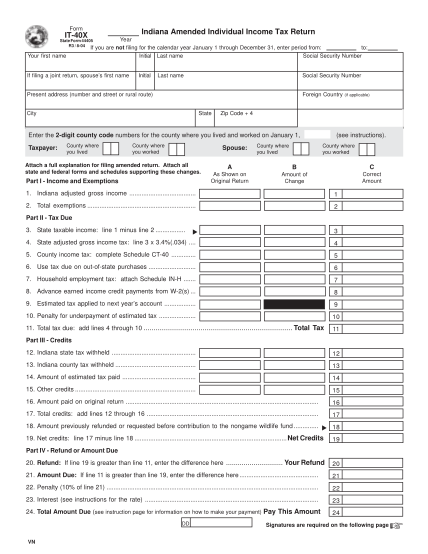

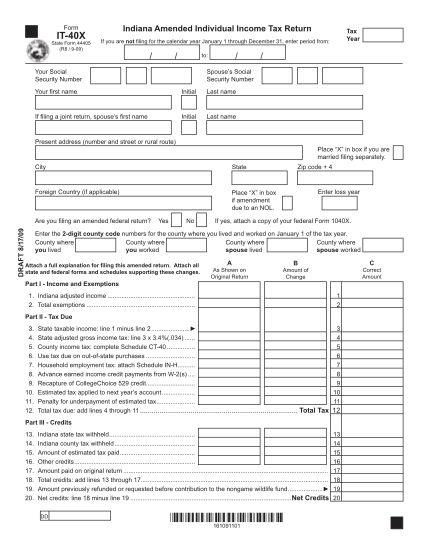

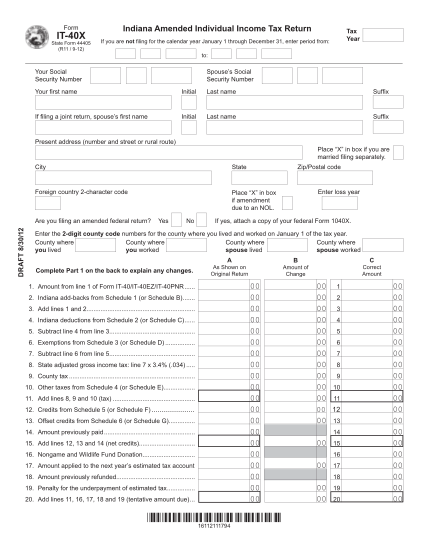

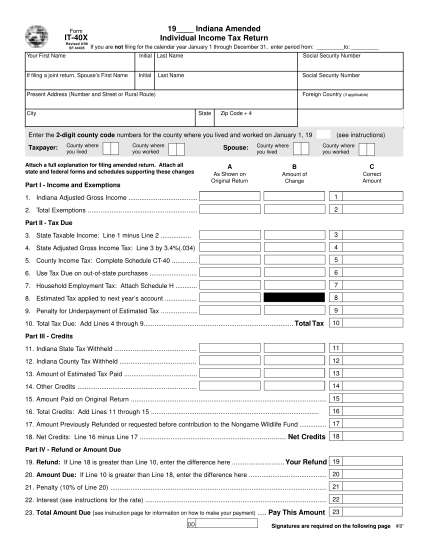

19 Indiana Amended Individual Income Tax Return IT-40X

19 indiana amended individual income tax return form it40x revised 8/98 sf 05 if you are not filing for the calendar year january 1 through december 31, enter period from: to: your first name initial last name social security number if filing a...

FILL NOW