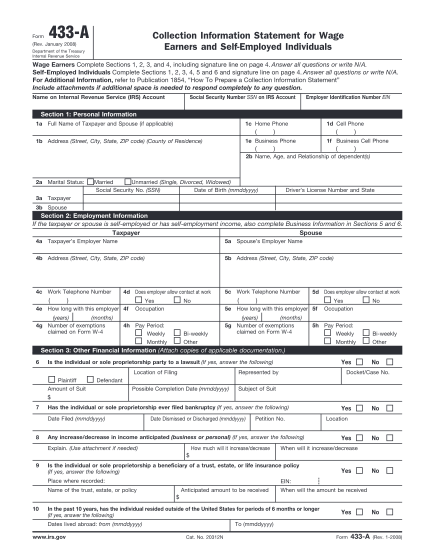

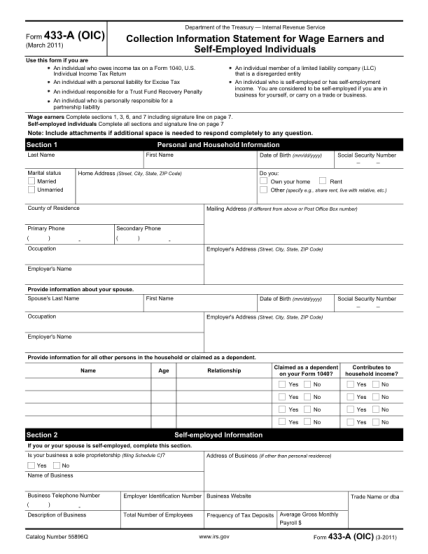

(Forma 433-A(SP)) - Internal Revenue Service

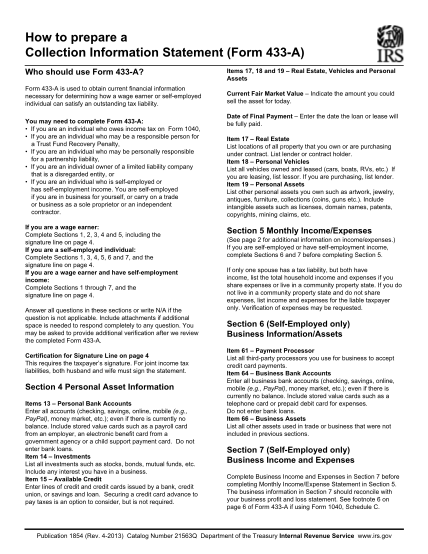

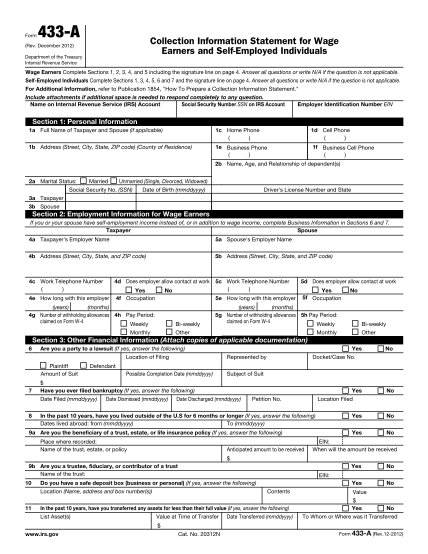

C mo preparar la informaci n de cobro para los asalariados y los individuos aut nomos (forma 433-a(sp)) qui n debe usar la forma 433-a(sp)? la forma 433-a(sp) se usa para obtener la informaci n financiera actual necesaria para determinar c mo un...

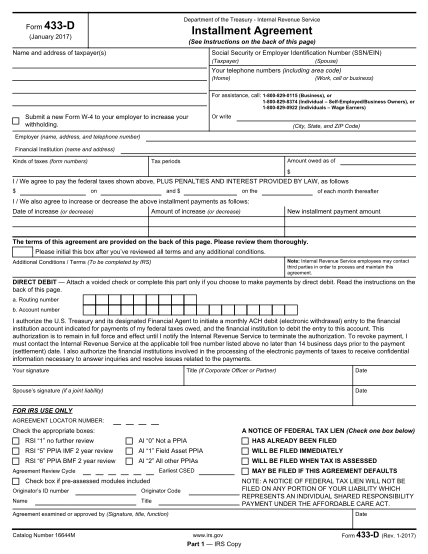

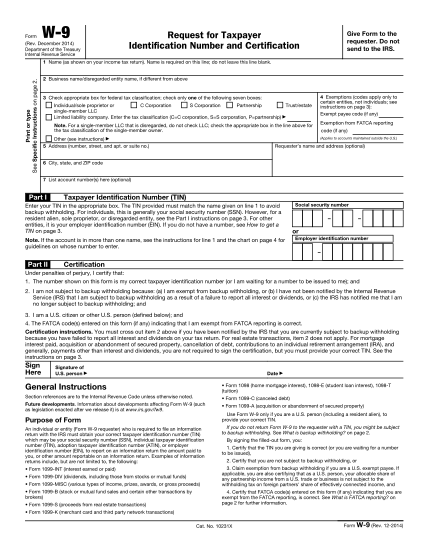

FILL NOW