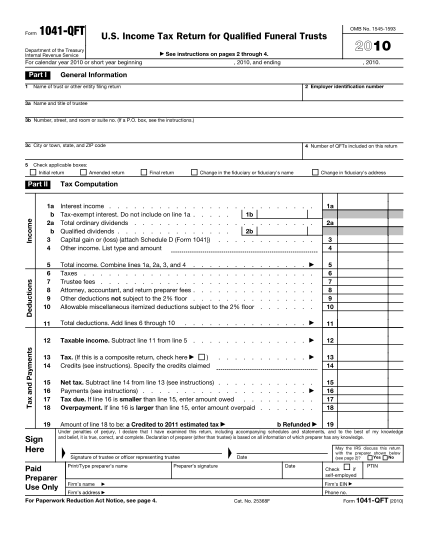

2010 1041-QFT form

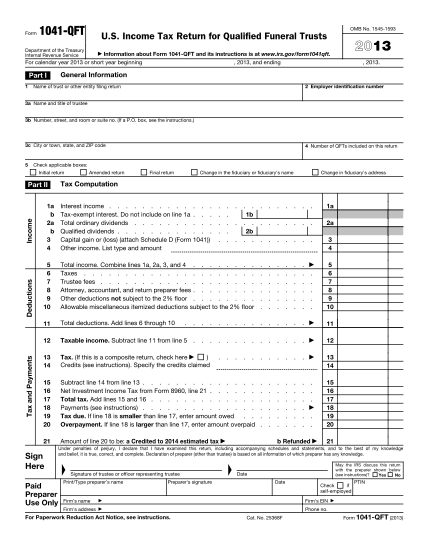

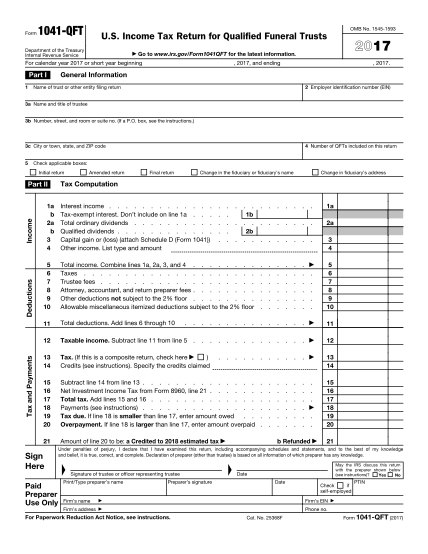

Form 1041-QFT U.S. Income Tax Return for Qualified Funeral Trusts OMB No. 1545-1593 Department of...

FILL NOW

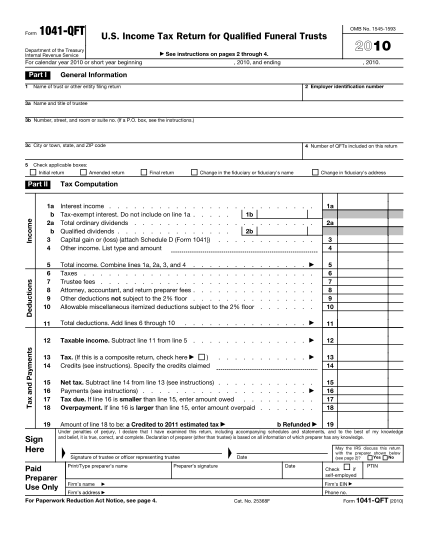

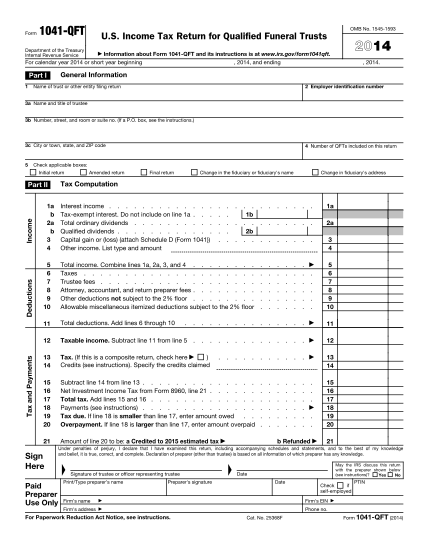

Form 1041-QFT U.S. Income Tax Return for Qualified Funeral Trusts OMB No. 1545-1593 Department of...

FILL NOW

Return check this box and enter on line 13 the total of the tax computed separately for each QFT...

FILL NOW

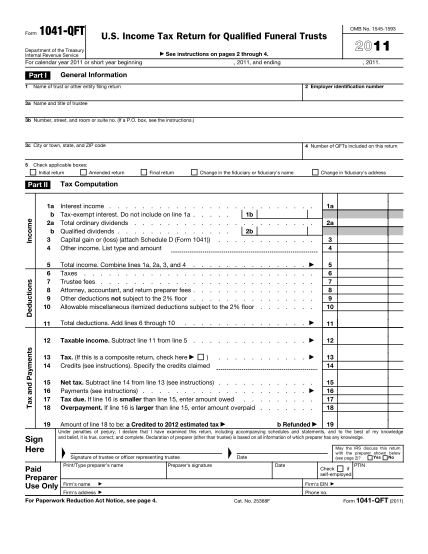

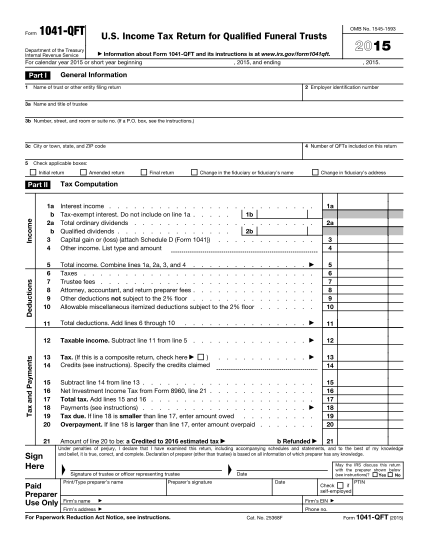

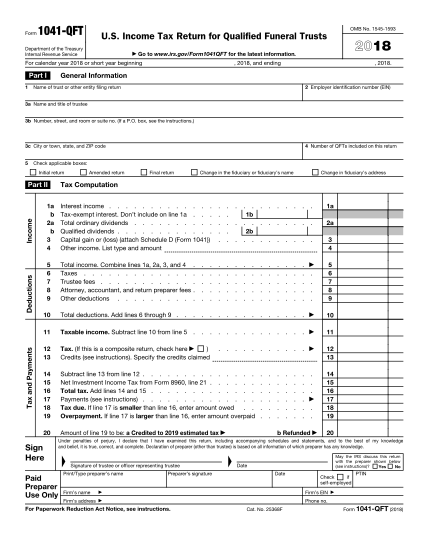

Form 1041-QFT OMB No. 1545-1593 U.S. Income Tax Return for Qualified Funeral Trusts Department of...

FILL NOW

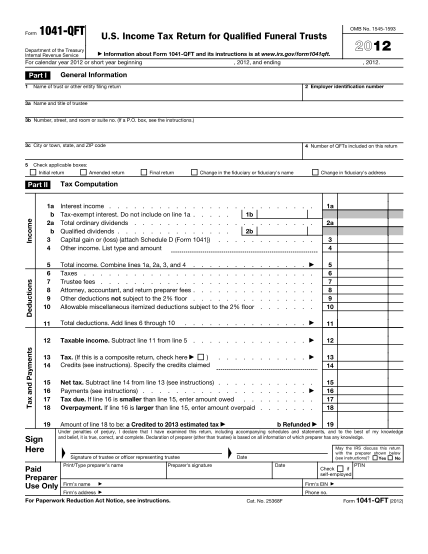

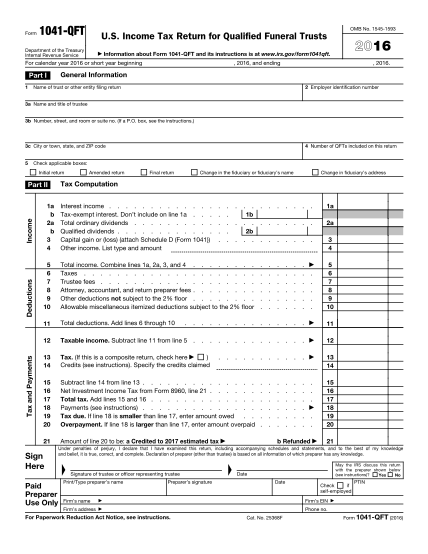

Form 1041-QFT OMB No. 1545-1593 U.S. Income Tax Return for Qualified Funeral Trusts Department of...

FILL NOW

Write the EIN from line 2 of the form and 2014 Form 1041-QFT on the payment. Enclose but do not...

FILL NOW

Write the EIN from line 2 of the form and 2015 Form 1041-QFT on the payment. Enclose but do not...

FILL NOW

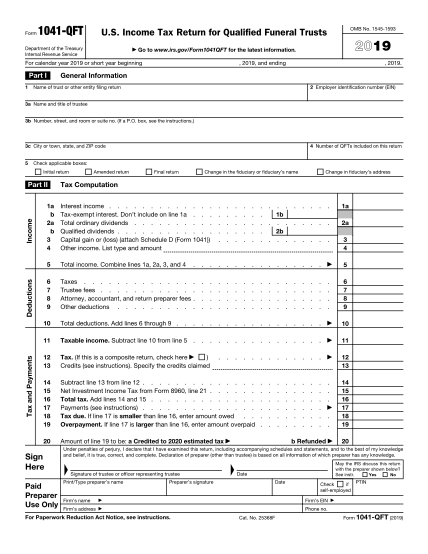

Form 1041-QFT U.S. Income Tax Return for Qualified Funeral Trusts Department of the Treasury...

FILL NOW

A trustee must use a separate EIN for every Form 1041-QFT it files. A QFT without an EIN can...

FILL NOW

Making the Election as a QFT by filing Form 1041-QFT for the trust by the due date including...

FILL NOW

A trustee must use a separate EIN for every Form 1041-QFT it files. A QFT without an EIN can...

FILL NOW

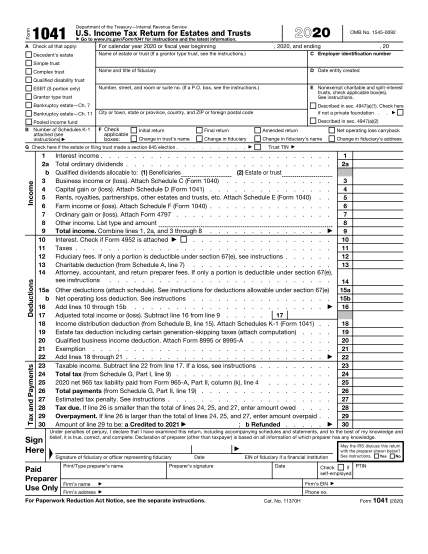

Form1041QFTDepartment of the Treasury Internal Revenue Service12020Go to www.irs.gov/Form1041QFT...

FILL NOW