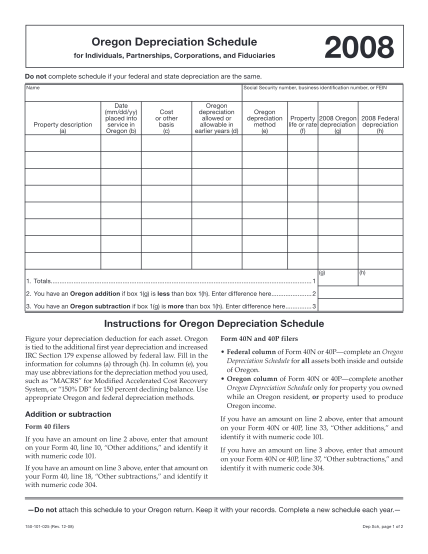

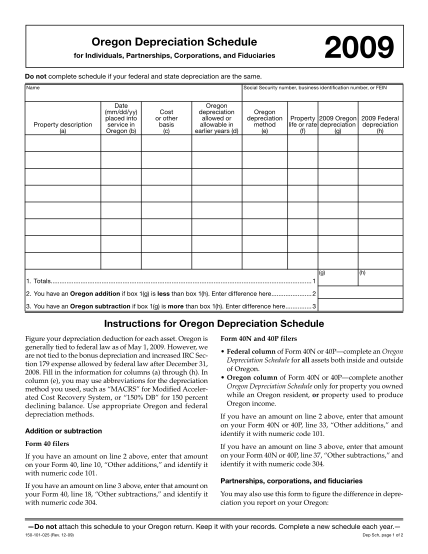

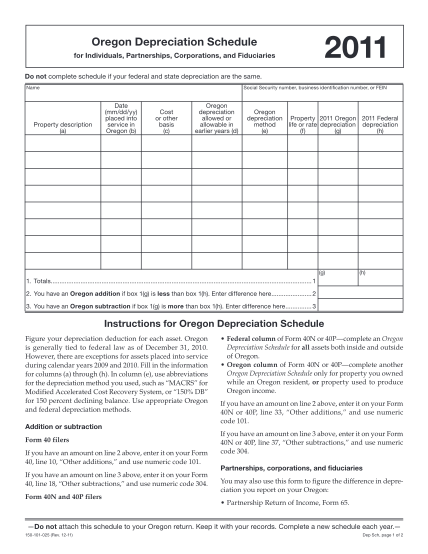

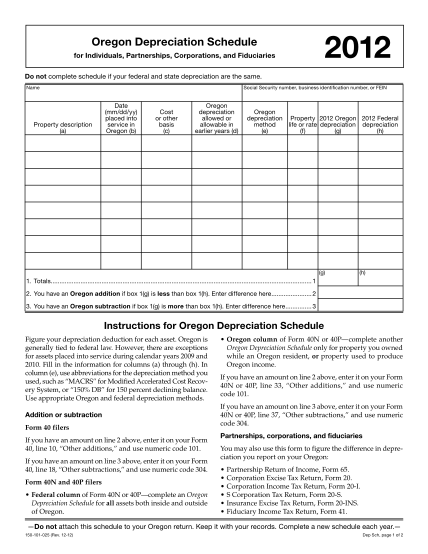

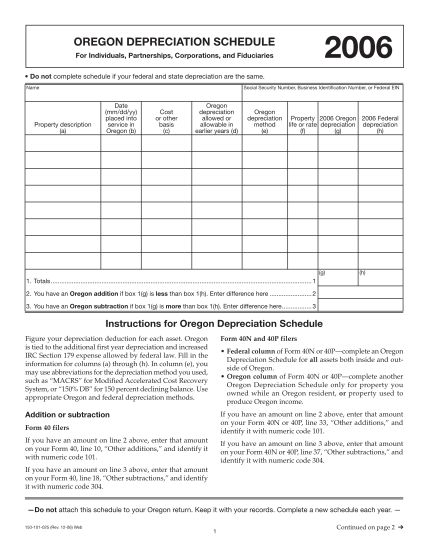

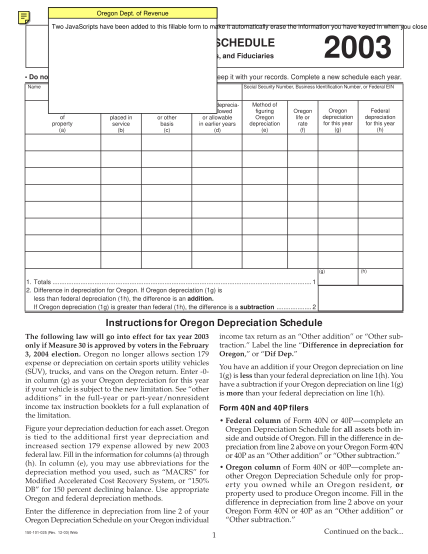

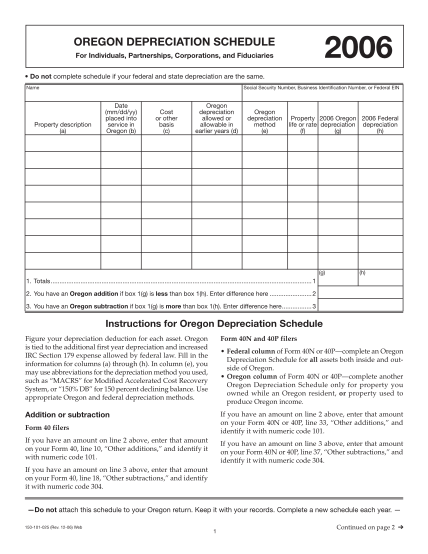

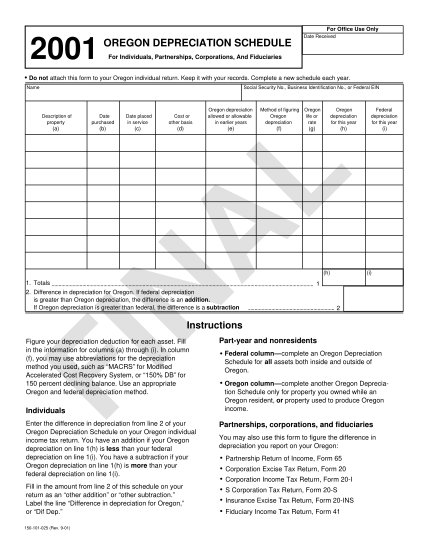

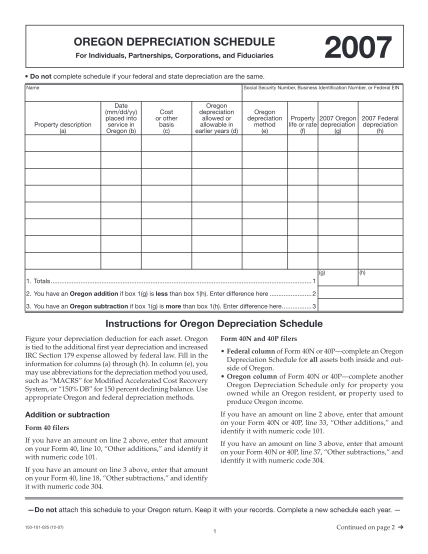

2007 Oregon Depreciation Schedule for Individuals, Partnerships, Corporations, and Fiduciaries, 150-101-025 - oregon

150-101-025 (rev. 12-10). dep sch, page 1 of for individuals, partnerships, corporations, and fiduciaries. do not complete schedule if your federal and state depreciation are the same. name . on june 1, 2007, jeff bought a light truck for

FILL NOW