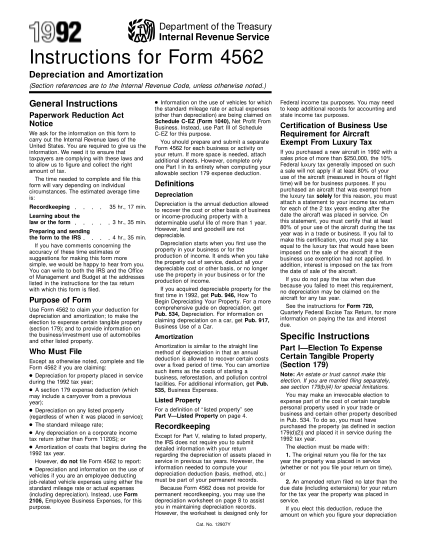

1992 Inst 4562. Instructions for Form 4562 - irs

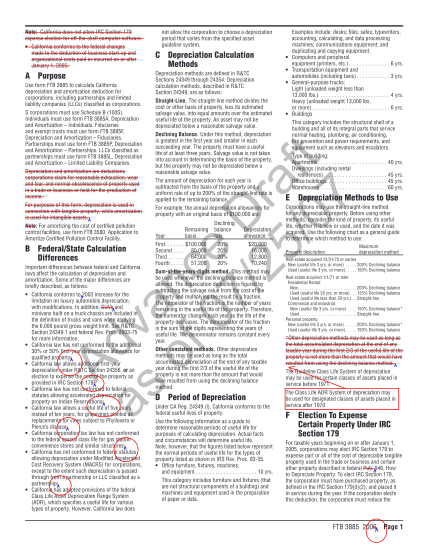

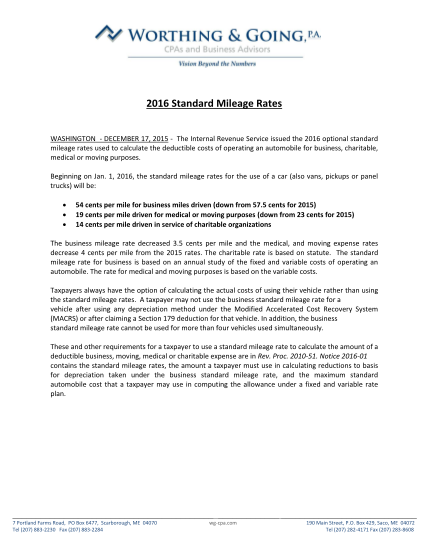

Department of the treasury internal revenue service instructions for form 4562 depreciation and amortization (section references are to the internal revenue code, unless otherwise noted.) general instructions paperwork reduction act notice we ask...

FILL NOW