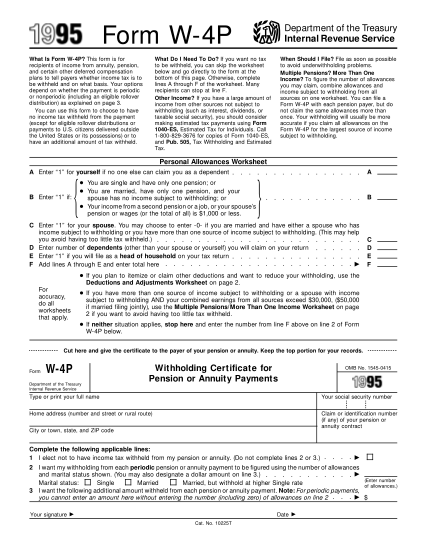

1995 Form W-4P. Withholding Certificate for Pension or Annuity Payments - irs

Department of the treasury internal revenue service form w-4p what is form w-4p? this form is for recipients of income from annuity, pension, and certain other deferred compensation plans to tell payers whether income tax is to be withheld and on...

FILL NOW