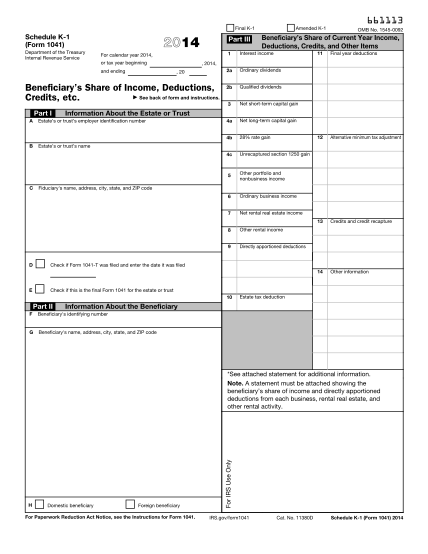

1041es instructions

2014 department of the treasury internal revenue service form 1041-es estimated income tax for estates and trusts section references are to the internal revenue code unless otherwise noted. future developments for the latest information about

FILL NOW