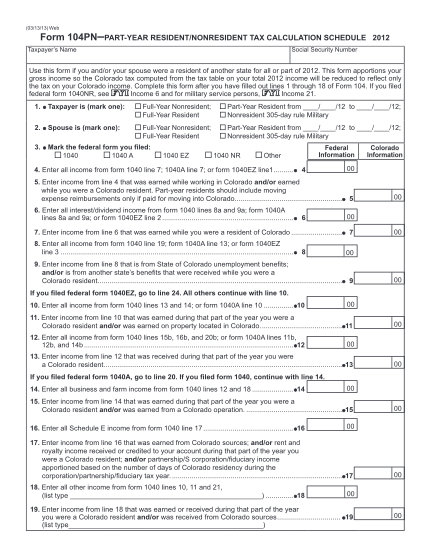

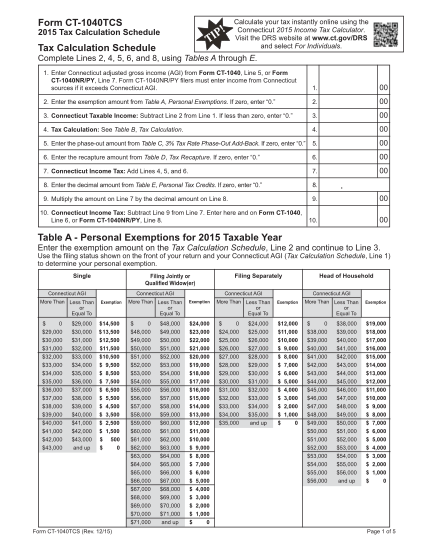

CT-1040TCS 2015 Tax Calculation Schedule 2015 Tax Calculation Schedule - ct

Form ct1040tcs ! ip t 2015 tax calculation schedule tax calculation schedule calculate your tax instantly online using the connecticut 2015 income tax calculator. visit the drs website at .ct.gov/drs and select for individuals. complete lines 2,...

FILL NOW