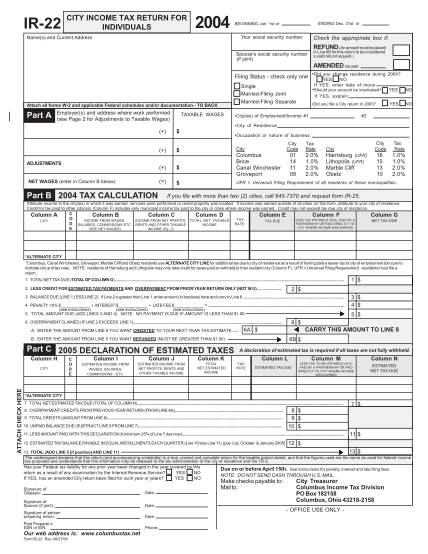

2004 TAX CALCULATION 2005 DECLARATION OF ... - Income Tax - incometax columbus

Ir-22 city income tax return for individuals 2004 beginning jan. 1st or ending dec. 31st or name(s) and current address your social security number check the appropriate box if: refund (an amount must be placed spouse's social security number (if...

FILL NOW