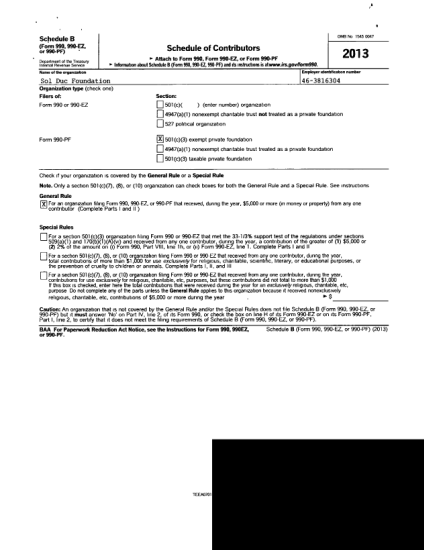

2009 Form 990 or 990-EZ (Schedule E). Schools

Caution: draft formthis is an advance proof copy of an irs tax form.it is subject to change and omb approval before itis officially released. you can check the scheduledrelease date on our web site (.irs.gov).if you have any comments on this draft...

FILL NOW