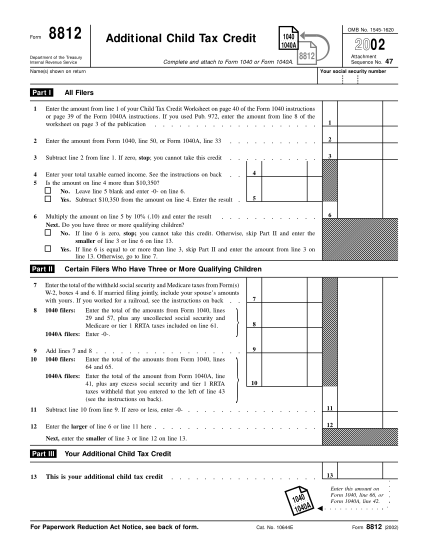

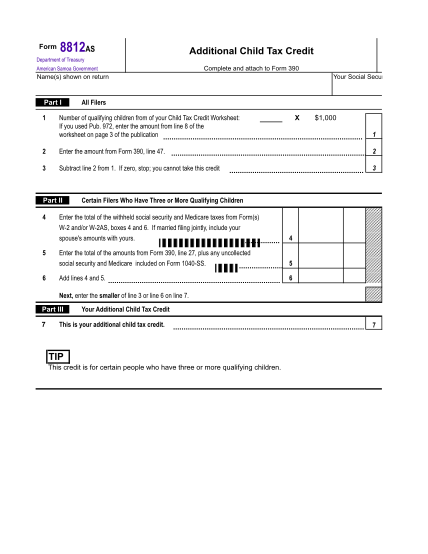

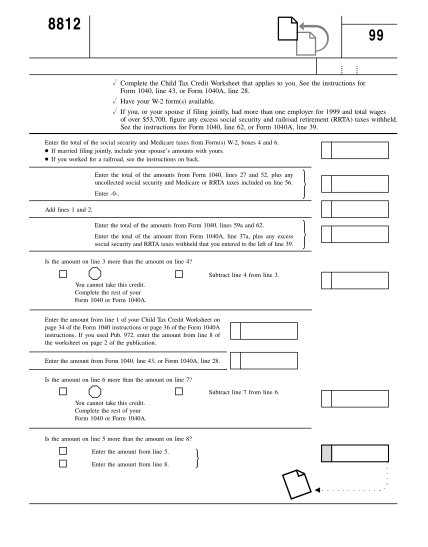

1999 Form 8812. Additional Child Tax Credit

Form 8812 omb no. 1545-1620 additional child tax credit complete and attach to form 1040 or 1040a. 1040 . 1040a department of the treasury internal revenue service 8812 1 attachment sequence no. 47 name(s) shown on return your social security...

FILL NOW