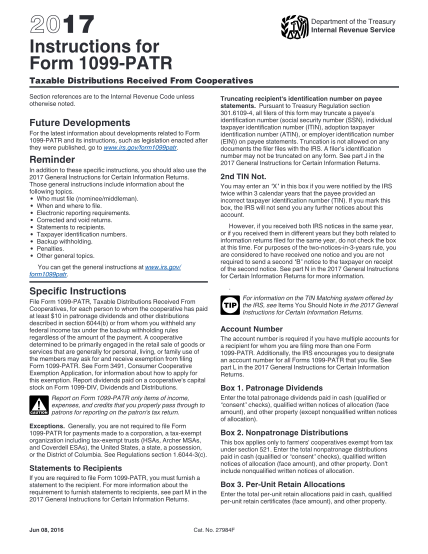

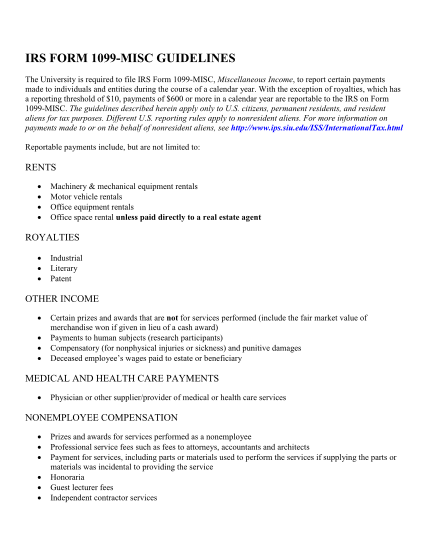

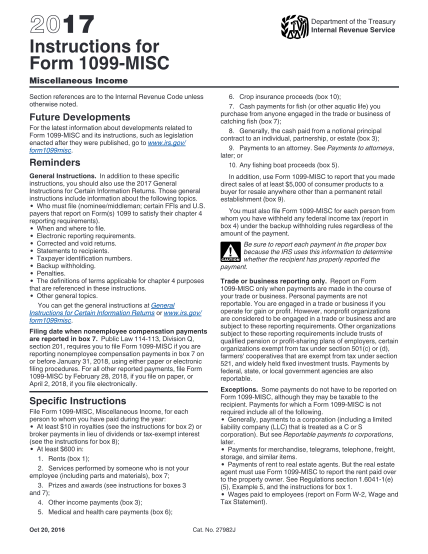

2017 Instructions for Form 1099-MISC. Instructions for Form 1099-MISC, Miscellaneous Income - irs

2017 department of the treasury internal revenue service instructions for form 1099misc miscellaneous income section references are to the internal revenue code unless otherwise noted. future developments for the latest information about...

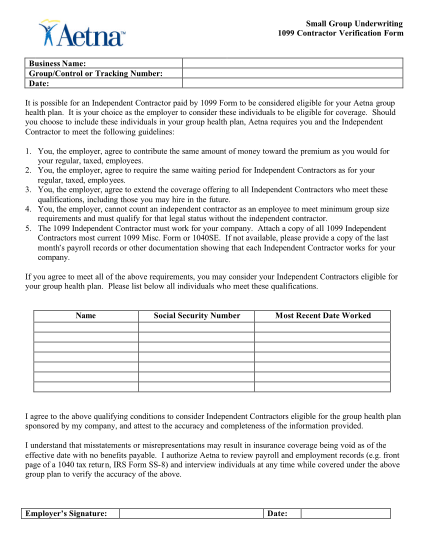

FILL NOW