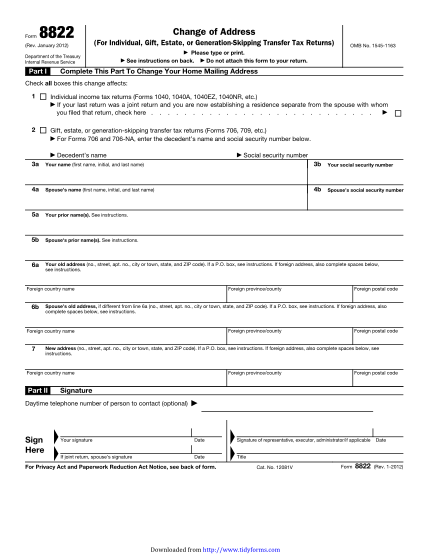

(For Individual, Gift, Estate, or GenerationSkipping Transfer Tax Returns)

Form 8822 (rev. january 2012) change of address (for individual, gift, estate, or generation-skipping transfer tax returns) department of the treasury internal revenue service part i omb no. 1545-1163 please type or print. see instructions on...

FILL NOW