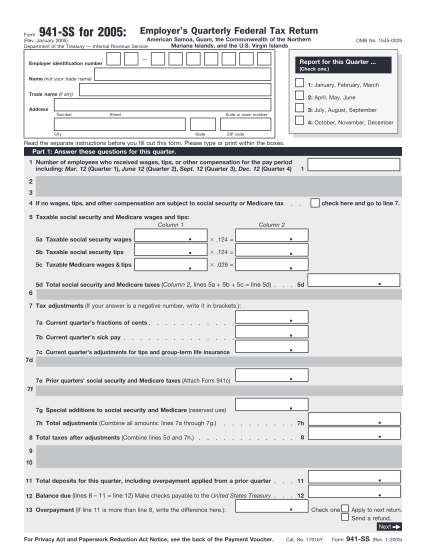

941 form for 2015 - massachusetts form m 3 instructions

M-3 w1,r business name massachusetts department of revenue reconciliation of massachusetts income taxes withheld for employers filing quarterly you must file this form even though no tax may be due. federal identification number be sure this form...

FILL NOW