1095 Inst 8283. Instructions for Form 8283 - irs

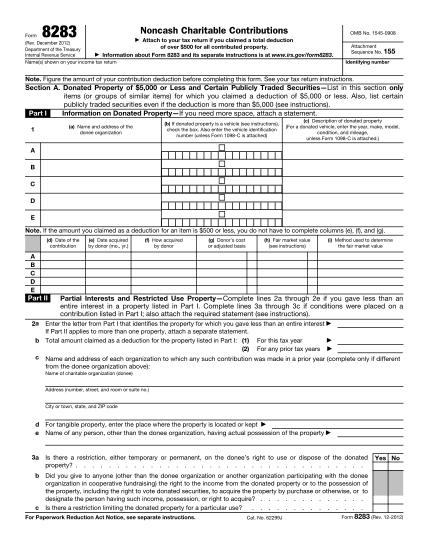

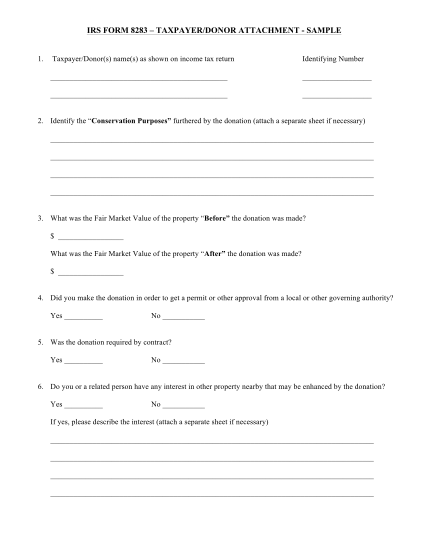

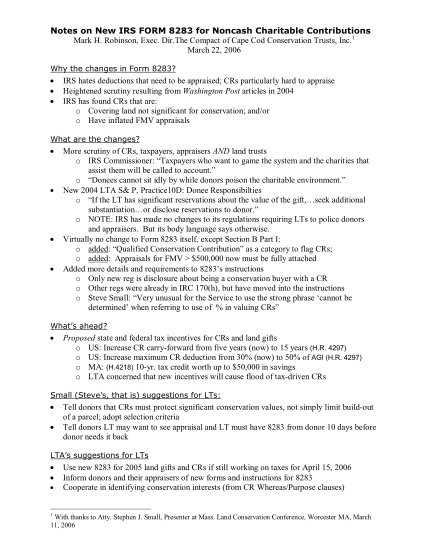

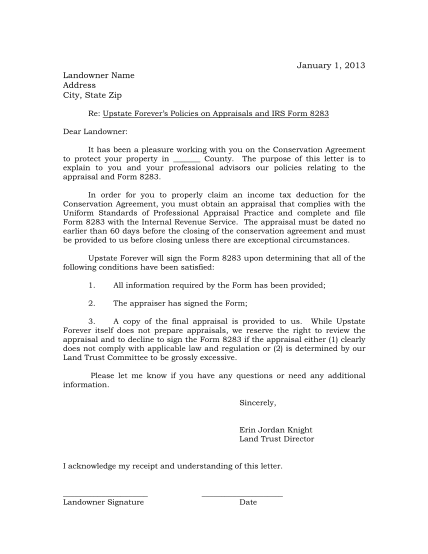

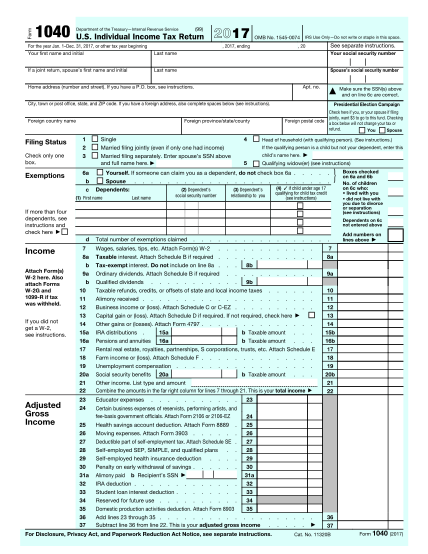

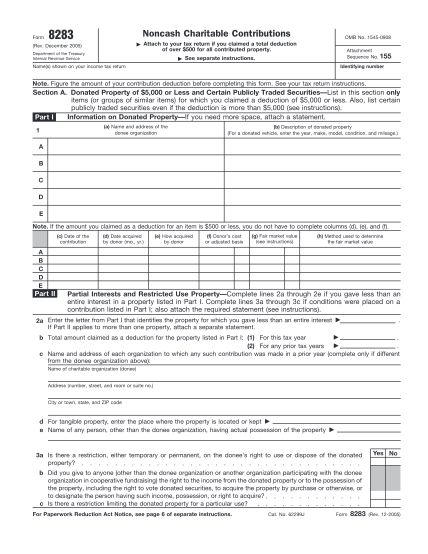

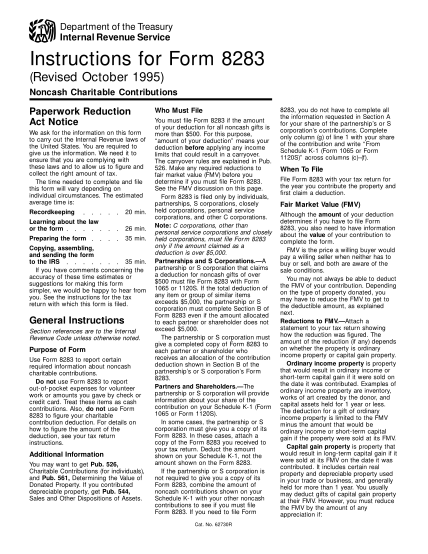

Department of the treasuryinternal revenue serviceinstructions for form 8283(revised october 1995)noncash charitable contributionspaperwork reductionact noticewe ask for the information on this formto carry out the internal revenue laws ofthe...

FILL NOW