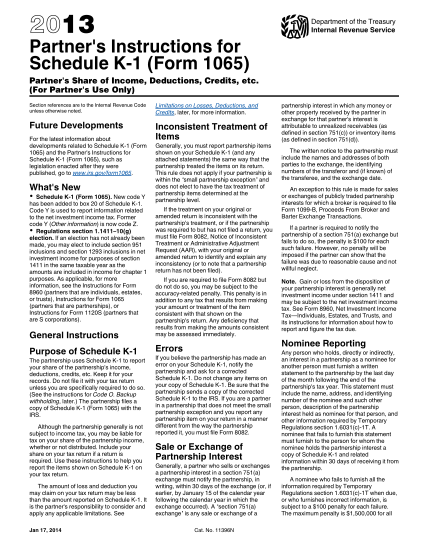

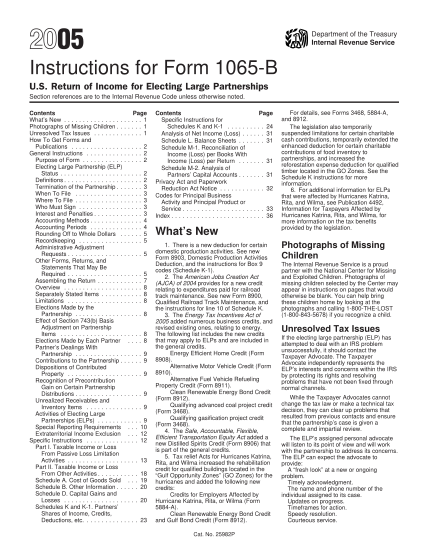

2005 Instruction 1065-B. Instructions for Form 1065-B, U.S. Return of Income for Electing Large Partnerships - irs

Pager/sgml userid: fileid: i1065b.sgm leading adjust: -5% (21-feb-2006) (init. & date) ok to print filename: c: epicuser i1065b.sgm page 1 of 36 instructions for form 1065-b 10:07 - 21-feb-2006 the type and rule above prints on all proofs...

FILL NOW