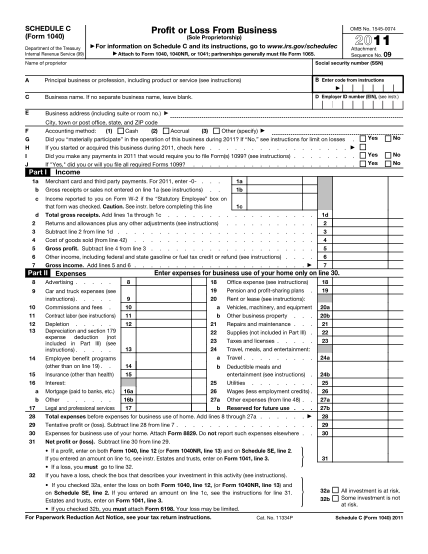

2011 2106 ez form

Form 2106-ez unreimbursed employee business expenses omb no. 1545-0074 department of the treasury internal revenue service (99) your name attach to form 1040 or form 1040nr. occupation in which you incurred expenses attachment sequence no. social...

FILL NOW