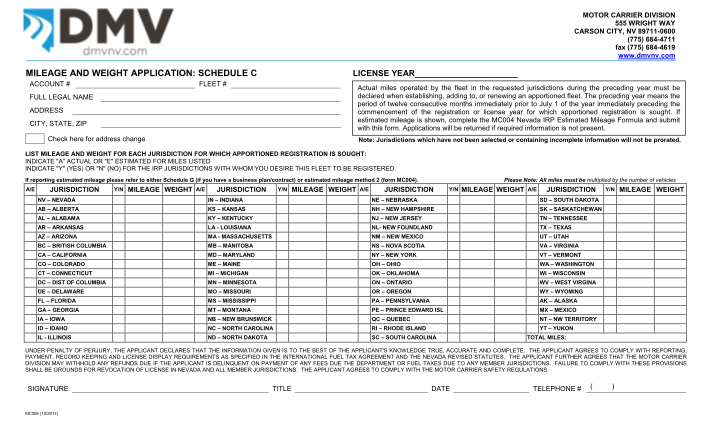

nv mileage and weight application schedule c form

Motor carrier division wright way carson city, nv 89711-0600 (775) 684-4711 fax (775) 684-4619 .dmvnv.com mileage and weight application: schedule c account # full legal name address city, state, zip check here for address change fleet # license...

FILL NOW